What Is Crypto Asset Allocation and How Does it Impact Your Portfolio?

Learn how crypto asset allocation shapes your portfolio's performance. Discover strategies to balance risk and reward for optimal returns in the crypto market.

9 minutes

Managing a cryptocurrency portfolio feels like solving a complex puzzle. The crypto market offers thousands of digital assets, and conditions change daily. Many investors find it challenging to pick the right mix of cryptocurrencies that match their investment goals.

A well-balanced crypto portfolio helps you guide through these challenges. The right mix of diversified cryptocurrency investments can make a big difference.

Let's take a closer look at the steps, strategies, and tools you need to build and maintain a resilient crypto portfolio that matches your risk tolerance and investment objectives.

This piece shows you proven ways to allocate crypto assets. You'll understand the basics of portfolio management and find practical tools to track and adjust your investments as needed.

What is Crypto Asset Allocation?

Crypto asset allocation helps investors distribute their money among digital assets in a methodical way. This strategy works like a roadmap that shows exactly how much capital you should put into different cryptocurrencies.

Each asset gets a specific percentage of your total portfolio value. A well-planned crypto portfolio allocation delivers several key benefits:

- It gives you a clear direction for investment choices.

- You get a solid way to measure growth and results.

- Your risk levels stay under control.

- Portfolio monitoring becomes easier.

- You can track your progress toward financial targets systematically.

The real value of crypto asset allocation comes from its adaptability to your needs. You can consider your specific requirements like investment timeframe, market expectations, and risk tolerance to decide how much to invest where.

This customized strategy lets you build a portfolio that matches your financial goals and gives you a reliable framework to make decisions.

Crypto asset allocation plays a crucial role in handling risk. Every digital asset comes with its own ups and downs and risk characteristics that affect how your portfolio performs.

You can better protect yourself from market swings by carefully choosing what percentage of your portfolio goes into each cryptocurrency. This approach helps you manage volatility while keeping growth opportunities open.

How Asset Allocation Impacts Your Crypto Portfolio?

Crypto portfolio allocation does more than just diversify investments. Studies reveal that adding cryptocurrencies to traditional investment portfolios can boost overall performance with the right strategy.

Research suggests an optimal portfolio includes a modest crypto allocation of 3-6% to balance performance and risk. To name just one example, portfolios with 3% Bitcoin and 3% Ethereum alongside traditional assets showed better risk-adjusted returns than standard investment combinations.

Proper crypto asset allocation offers these benefits:

- Better portfolio Sharpe ratio

- Better risk-adjusted returns

- Low correlation with traditional assets

- Higher potential returns

- Portfolio diversification advantages

Cryptocurrencies are volatile by nature, but their low correlation with traditional assets makes them great for portfolio diversification.

However, investors should remember that crypto exposure above recommended levels can raise portfolio risk substantially. Success comes from balance - most investors should limit crypto to 5% of their total portfolio value.

Smart crypto portfolio allocation can help optimize investment strategy. Regular rebalancing and systematic portfolio management let investors tap into better returns while keeping risks in check.

What is a Good Crypto Portfolio Allocation?

New surveys show that financial advisors now feel more at ease when they recommend specific cryptocurrency allocations to their clients.

Most advisors suggest a 2-5% allocation of the total investment portfolio to cryptocurrencies. This creates a sweet spot between potential returns and risk control.

Your ideal crypto portfolio allocation changes by a lot based on your risk appetite:

- Conservative investors (low-risk): Under 5% allocation

- Moderate investors: Up to 20% allocation

- Aggressive investors (high-risk): Maximum 30% allocation

The 80/20 rule works great if you're just starting with cryptocurrency investments. You should put 80% of your crypto portfolio in prominent cryptocurrencies like Bitcoin and Ethereum. The other 20% can go into carefully picked mid and small-cap digital assets.

A balanced crypto portfolio needs both market capitalization diversity and sector distribution. This strategy helps reduce the effects of market swings while you stay exposed to growth prospects.

However, too much diversification might turn your portfolio into a market mirror, which could restrict both profits and losses.

Success in crypto portfolio allocation comes from regular monitoring and rebalancing. You need to maintain your target proportions as markets shift. This methodical strategy lets you stick to your risk comfort zone while you grab market opportunities.

Importance of Portfolio Monitoring and Adjustment

Cryptocurrency investing goes beyond the original portfolio setup - you just need to monitor and adjust your strategy. Smart investors track their investment performance and make informed decisions based on market conditions and portfolio metrics.

Risk Metrics to Track

These metrics are the foundations of a healthy portfolio assessment:

- Sharpe Ratio - measures risk-adjusted returns

- Portfolio Volatility - tracks price movement intensity

- Maximum Drawdown - shows potential loss exposure

- Beta - indicates market sensitivity

Rebalancing Triggers

Your portfolio needs rebalancing under specific conditions. The most common triggers work in two ways. Threshold-based rebalancing happens when asset weights shift beyond set percentages (usually 5-10%). Calendar-based rebalancing follows fixed schedules like quarterly or annual reviews.

Performance Analysis Tools

Modern crypto portfolio management depends on advanced tracking tools that give you live monitoring capabilities. These platforms are a great way to get portfolio insights through combined views, historical data, and custom alerts.

Investors can maintain their target allocations while getting informed insights to make better decisions.

A systematic approach to portfolio monitoring works best when you combine these tools and metrics with regular rebalancing. This strategy helps you stick to your target allocation and adapt to market changes.

How Does Botsfolio Help Investors Build Their Portfolio?

Botsfolio stands as a revolutionary force in crypto portfolio management with its automated investment platform. The system blends advanced technology with easy-to-use features that help investors build and maintain the best cryptocurrency portfolios.

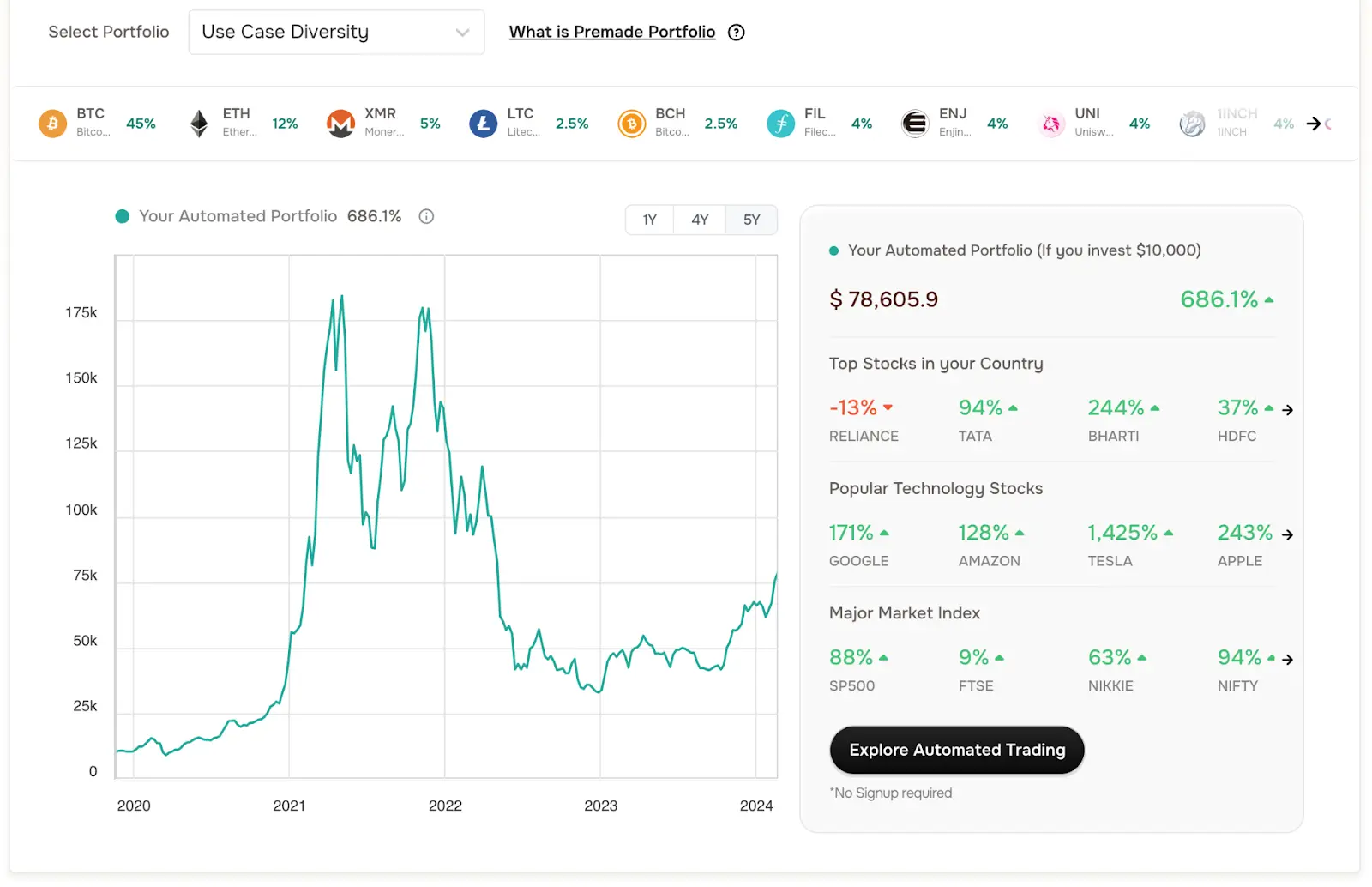

Botsfolio Premade Crypto Portfolio

Investors now have access to professionally designed portfolios with industry-leading cryptocurrencies and proven investment strategies.

These pre-made portfolios give you significant advantages:

- Automated risk management and portfolio optimization

- Expert-curated selection of top-performing assets

- Regular portfolio rebalancing and monitoring

- A smart solution that saves time for busy investors

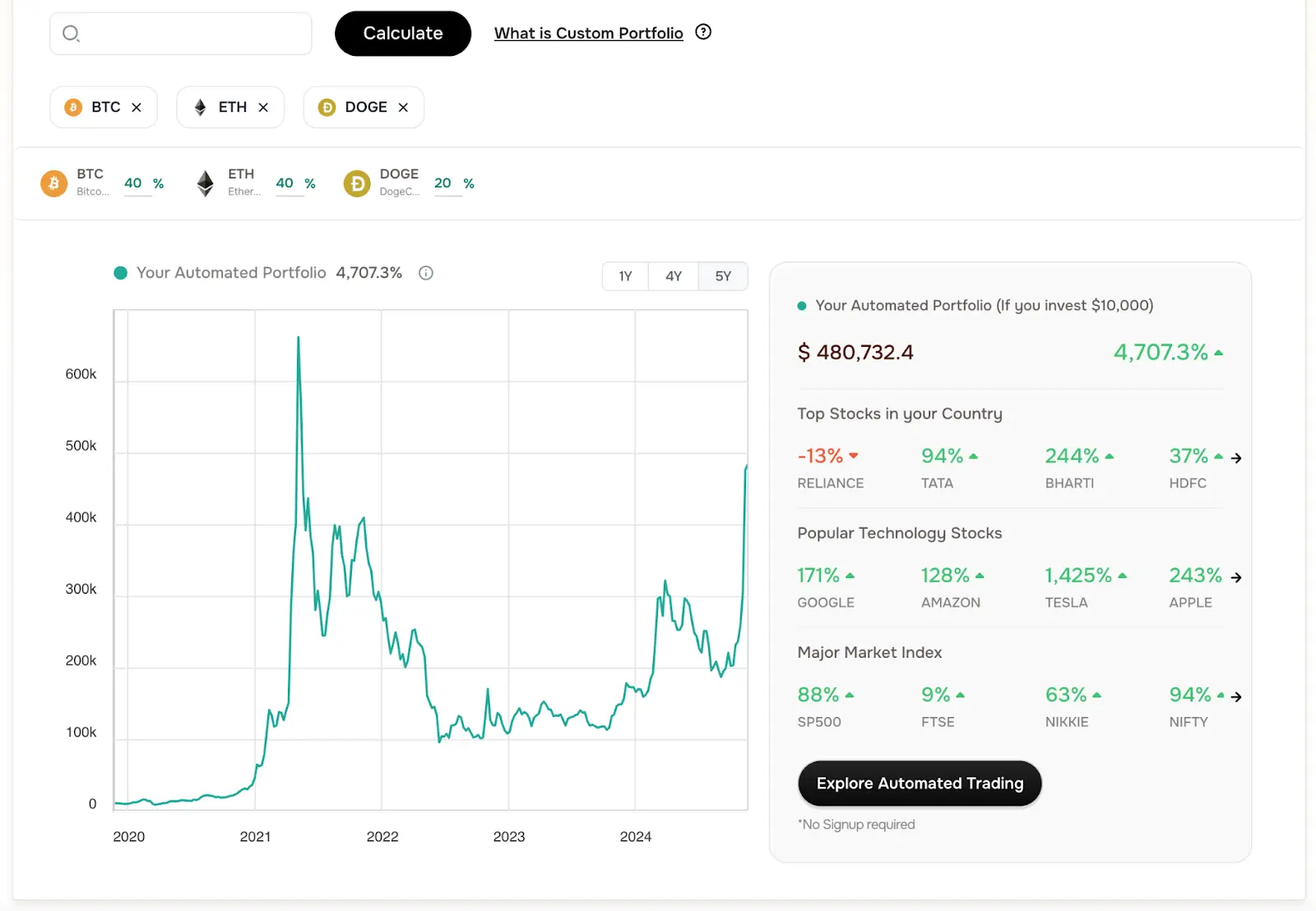

Botsfolio Custom Crypto Portfolio

The Botsfolio custom portfolio feature lets investors customize their portfolio allocation while retaining automated management benefits. You can adjust your investment strategy by picking specific coins and setting allocation percentages based on your risk tolerance and goals.

The platform's AI-powered trading bot optimizes investments around the clock and executes trades automatically to maintain the desired portfolio balance.

This systematic approach eliminates emotional decision-making from investing and keeps portfolios arranged with predetermined strategies.

The platform connects to major cryptocurrency exchanges for uninterrupted trading execution. Its easy-to-use interface makes portfolio management available to investors at every experience level. Detailed analytics tools help you track performance and make smart decisions about your crypto asset allocation.

Best Ways to Diversify Your Crypto Portfolio

Diversification is the key to a successful crypto portfolio that protects investors from market volatility and maximizes potential returns.

Smart investors know that spreading investments among different cryptocurrency types and sectors builds a stronger portfolio.

A well-laid-out crypto diversification strategy has:

- Investments in different market capitalizations (large, mid, and small-cap cryptocurrencies)

- Investments spread in blockchain protocols of all types

- Fund allocation to different cryptocurrency sectors

- Geographic diversity in token selection

- Alternative crypto investments

Smart investors should think over alternative crypto investments like blockchain technology companies or mining operations that provide industry exposure without direct cryptocurrency ownership. These alternatives bring different risk-reward profiles compared to direct crypto investments.

Strategies for Crypto Asset Allocation

Successful crypto portfolio allocation needs a smart strategy that blends several investment methods. Smart investors who know these strategies can succeed in the volatile cryptocurrency market.

Market Capitalization Allocation

Market capitalization weighting stands as a basic strategy to build your crypto portfolio. Most investors put more money into established cryptocurrencies with big market caps and keep smaller amounts in newer assets.

Large-cap cryptocurrencies show less volatility than smaller ones, which helps balance stability and growth potential.

Geographic Allocation

Smart investors spread their crypto investments across different jurisdictions to reduce regulatory risks. Crypto-friendly jurisdictions create stable environments for digital asset projects.

Strict regulatory environments can offer opportunities through compliant, proven projects. This approach protects your portfolio when regulations change in specific regions.

Types of Cryptocurrencies

A well-laid-out portfolio has several cryptocurrency types:

- Pure Currency Coins (Bitcoin) - For value storage and transactions

- Smart Contract Platforms (Ethereum) - Supporting decentralized applications

- Utility Tokens - Providing specific ecosystem functions

- Stablecoins - Offering price stability and liquidity options

- Security Tokens - Representing ownership in underlying assets

Success comes from balancing these categories and adjusting them based on market conditions and your investment goals. This complete approach creates a strong portfolio that handles market swings while finding growth opportunities.

Sector Based Diversification

Sector-based diversification lets investors tap into growth from different areas of the crypto ecosystem. DeFi protocols, gaming tokens, and infrastructure projects react differently to market conditions and create natural hedges within the portfolio.

Implementing Your Crypto Asset Allocation Strategy

A crypto portfolio strategy needs careful preparation and the right tools to get started. You should pick a reliable portfolio-tracking platform that matches your investment goals and security needs.

Here's what you need to do:

- Set up secure storage through both hot and cold wallets.

- Pick a portfolio tracking platform with strong security features.

- Connect with your preferred cryptocurrency exchanges.

- Set up automated trading, monitoring and alert systems.

- Create a regular schedule to review your portfolio.

Security considerations are crucial to your success. Your platform should have two-factor authentication, encryption, and cold storage options. Hardware wallets add extra protection for long-term holdings. Hot wallets work better when you trade actively.

Portfolio tracking platforms work as your command centre. They give you immediate monitoring, performance analytics, and automated rebalancing features.

These tools merge naturally with your exchanges and wallets. They are a great way to get complete reports that you'll need for taxes.

Your success depends on a disciplined approach to portfolio management. Watch your investments regularly and set up automated alerts for price changes and portfolio milestones. This helps you stick to your allocation strategy and make smart decisions about rebalancing and adjustments.

Conclusion

A well-planned cryptocurrency portfolio just needs thoughtful planning and regular monitoring with timely adjustments. Successful investors know they must balance major cryptocurrencies with newer assets.

They also keep their risks in check through diversification. Most investors put 80% of their money in major cryptocurrencies and 20% in carefully picked smaller projects.

These percentages should match how much risk you're willing to take.

Modern portfolio management tools and automated platforms make it easier to track and rebalance crypto investments.

You can use these economical solutions to keep your target allocations while adapting to market changes. Your portfolio will stay in sync with your long-term investment goals when you regularly check key metrics and stick to disciplined rebalancing.

Crypto investing works best with patience, research, and a methodical approach to managing your portfolio. Long-term success in the ever-changing cryptocurrency market comes to investors who stick to these principles.

Written By

Jay Sharma

Jay is a seasoned crypto entrepreneur and technology innovator. As the Founder and CEO of Botsfolio, he has been at the forefront of the blockchain revolution since 2017. His practical experience extends to the technical nuances of crypto mining, having successfully built and managed a substantial GPU mining operation. Jay developed a groundbreaking decentralised application for fractional real estate NFTs. This innovative project garnered significant recognition. Through his hands-on experience and analysis, he aims to provide valuable guidance and empower others to navigate the dynamic crypto landscape.

You Might Also Want To Read

7 Best Crypto Sentiment Analysis Tools - C...

Discover top crypto sentiment analysis tools to gauge market mood. Enhance your trading strateg...

S. Vishwa

7 minutes

Bitcoin's Taproot Update: Impact on Market...

Delve into the implications of Bitcoin's Taproot upgrade for market trends and investor sentime...

Jay Sharma

7 minutes

AI in Cryptocurrency Markets: Exploring Tr...

Explore the intersection of artificial intelligence and cryptocurrency markets, revealing strat...

Jay Sharma

8 minutes

Who Hates Bitcoin? Reasons and Controversi...

Discover why some entities dislike Bitcoin and the underlying controversies surrounding its ado...

Jay Sharma

10 minutes

Impact of Global Tax Rates on Cryptocurren...

Learn how global tax rates influence cryptocurrency investments and strategies. Stay informed w...

Jay Sharma

11 minutes

Master Cryptocurrency: Expert Insights & L...

Unlock the secrets of cryptocurrency with expert analysis and stay updated on the latest trends...

Jay Sharma

9 minutes

You Might Also Want To Read

7 Best Crypto Sentiment Analysis Tools - C...

Discover top crypto sentiment analysis tools to gauge market mood. Enhance your trading strateg...

S. Vishwa

7 minutes

Bitcoin's Taproot Update: Impact on Market...

Delve into the implications of Bitcoin's Taproot upgrade for market trends and investor sentime...

Jay Sharma

10 minutes

AI in Cryptocurrency Markets: Exploring Tr...

Explore the intersection of artificial intelligence and cryptocurrency markets, revealing strat...

Jay Sharma

8 minutes

Who Hates Bitcoin? Reasons and Controversi...

Discover why some entities dislike Bitcoin and the underlying controversies surrounding its ado...

Jay Sharma

8 minutes

Impact of Global Tax Rates on Cryptocurren...

Learn how global tax rates influence cryptocurrency investments and strategies. Stay informed w...

Jay Sharma

8 minutes

Master Cryptocurrency: Expert Insights & L...

Unlock the secrets of cryptocurrency with expert analysis and stay updated on the latest trends...

Jay Sharma

10 minutes

The content, portfolios, and insights presented on this platform are provided for informational purposes only and do not constitute financial, investment, or trading advice. Kribx Inc. and its affiliated influencers are not registered investment advisors or broker-dealers. Cryptocurrency trading involves substantial risk and may result in the loss of capital. Users are solely responsible for their trading decisions. Past performance is not indicative of future results.

PRODUCTS

RESOURCES

COMMUNITY GROUPS

© 2026 © Botsfolio