How to Analyze New Crypto Projects Before Investing? - A Comprehensive Guide

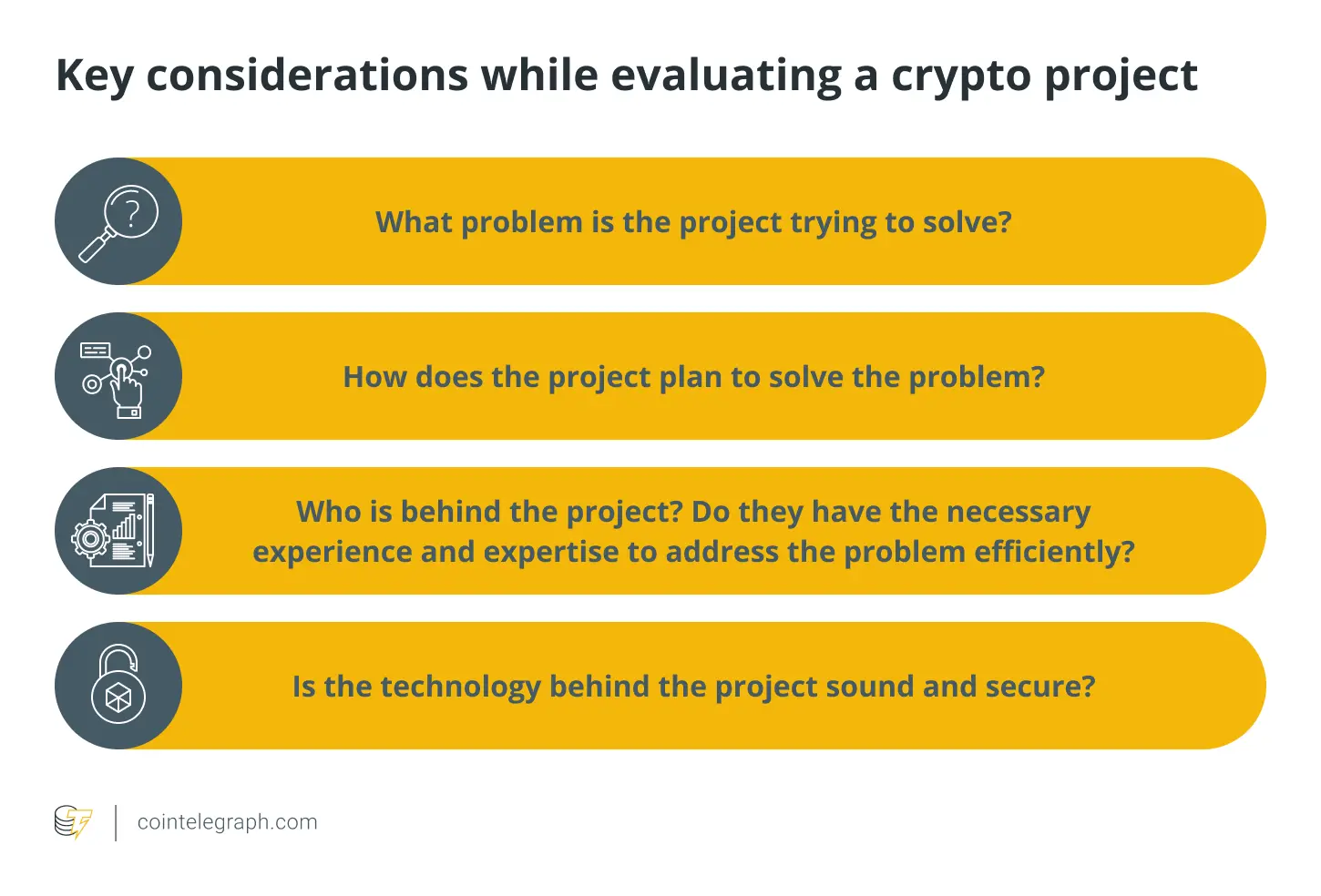

The crypto space is wild and constantly evolving! New projects are launching every day, and it can be tempting to jump on the next hot coin. But before you throw your money at any random coin, it is crucial to do your homework.

This guide will walk you through the essential steps to analyze new crypto projects before you invest.

By the end, you'll have a robust framework for conducting thorough crypto research, enabling you to spot potential gems in the ever-expanding crypto universe.

Explore the Project's Website

When researching a cryptocurrency, the first place to look is usually their website. A good website is like a first impression. It should be easy to understand and look professional.

It should clearly explain what the project does, who is behind it, and what they plan to achieve. Look for things like a clear mission statement, detailed information about the technology, and a roadmap of what they're working on.

A good website doesn't guarantee success, but it's a good sign that the team is serious about their project. Be wary of websites that are too flashy or don't provide much real information.

Dive into the White Paper

The white paper is the heart of any serious crypto project. It's a technical document that outlines the project's vision, technology, and tokenomics. When conducting your crypto research, a thorough analysis of the white paper is essential.

Here's what to look for when examining a project's white paper:

- Problem Statement: The document should clearly define the problem the project aims to solve. Evaluate whether this problem is significant and whether the proposed solution is truly necessary.

- Technical Details: Look for a detailed explanation of the project's technology. While you don't need to understand every technical aspect, the explanation should be clear and logical.

- Token Utility: The white paper should explain how the project's token will be used within its ecosystem. Be cautious of projects where the token seems unnecessary or its utility is unclear.

- Tokenomics: Examine the token distribution model, including the total supply, allocation to different stakeholders, and vesting schedules. A fair and transparent distribution is crucial for long-term success.

- Competitive Analysis: Look for a section that compares the project to existing solutions or competitors. This shows the team has a good understanding of their market position.

- Team and Advisors: While this information might also be on the website, the white paper often provides more detailed backgrounds of key team members and advisors.

A well-written white paper doesn't guarantee a successful project, but it's a good indicator of the team's expertise and the project's potential. Be wary of white papers that are overly technical without explaining practical applications, or those that focus more on hype than substance.

Evaluate Social Media and News Presence

A project's social media presence and news coverage can provide valuable insights into its legitimacy and potential. When researching new cryptocurrencies, it's crucial to examine these channels thoroughly.

Start by checking out their social media. See if they post regularly if people are actually talking about it, and if the team answers questions. Look for communities on platforms like Telegram or Reddit.

Read their blog posts to learn more. Then, do a quick search to see what the news is saying about the project. Pay attention to how often it's mentioned and whether the news is good or bad.

Remember, a lot of social media activity doesn't always mean a project is good. Be cautious of projects that seem too hyped up, as this can sometimes hide problems.

Research the Project Team and Partnerships

The team behind a crypto project can make or break its success. When conducting your crypto analysis, thoroughly researching the project's team and partnerships is crucial.

Start by examining the team members and project's partnerships:

- Leadership: Look into the backgrounds of founders and key executives. Do they have relevant experience in blockchain, finance, or technology?

- Technical Team: Evaluate the expertise of developers and engineers. Have they worked on successful projects before?

- Advisors: Check the credentials of any listed advisors. Are they respected figures in the crypto or relevant industries?

- Strategic Alliances: Look for partnerships with established companies or institutions. These can provide legitimacy and potential use cases.

- Technological Collaborations: Partnerships with other blockchain projects or tech companies can indicate a strong technological foundation.

- Investment Backers: Research any venture capital firms or notable investors supporting the project.

- Verify partnership claims through official announcements from both parties.

- Assess the relevance and potential impact of each partnership on the project's goals.

- Be wary of projects that exaggerate the significance of minor collaborations.

A strong team and meaningful partnerships don't guarantee success, but they significantly increase a project's chances of achieving its goals. Conversely, a weak or anonymous team should be seen as a red flag when researching new cryptocurrencies.

Study Price History

The price history can provide valuable insights into market sentiment and potential future performance. However, it's crucial to approach this analysis with a balanced perspective, understanding that past performance doesn't guarantee future results.

Here's how to effectively study a crypto project's price history:

- Long-term Trends: Look at the price chart over different time frames - 1 month, 6 months, 1 year, and all-time if available.

- Volatility: High volatility might indicate higher risk but also potential for greater returns. Compare the volatility to major cryptocurrencies like Bitcoin to gauge relative stability.

- Trading Volume: Analyze how trading volume correlates with price movements.

- Support and Resistance Levels: Identify price levels where the token has historically found support (stopped falling) or resistance (stopped rising).

- Market Cycles: Try to identify any recurring patterns or cycles in the price history.

- Comparison with Market Trends: Compare the token's price history with overall crypto market trends.

While price history is important, it should not be the sole factor in your decision-making process. Always combine this analysis with fundamental research about the project's technology, team, and real-world utility.

Determine Utility and Potential for Adoption

When conducting crypto research, one of the most crucial aspects to consider is the project's utility and its potential for widespread adoption. This factor can significantly impact the long-term viability and value of a cryptocurrency.

To figure out if a cryptocurrency project will actually be useful and successful, you need to look at a few things. First, does it solve a real problem? Does it offer something new and better than what already exists? Is it easy for people to use?

Will it get more valuable as more people join? Does it have strong partnerships with other companies? Is it following the rules and regulations? Does it have a supportive community and active developers?

Projects that can prove they're useful, solve real problems, and attract users are more likely to succeed in the long run.

Analyze the Tokenomics

Understanding a project's tokenomics is crucial when researching new cryptocurrencies. Think of tokenomics as the financial blueprint of a cryptocurrency.

It's like the rules of the game that determine how many coins exist, who gets them, and how they're used. Understanding tokenomics is key to evaluating a cryptocurrency.

Image Source - gncrypto.news

You need to check things like how many coins are in circulation, how they're distributed, and how they're used within the project. A good tokenomics model should create a fair and sustainable system for everyone involved.

A well-designed tokenomics should create a sustainable ecosystem that balances the interests of all stakeholders. Be wary of models that seem overly complex or those that primarily benefit a small group of insiders.

Evaluate the Technology

A thorough evaluation of the underlying technology is crucial. This assessment helps determine the project's viability, scalability, and potential for long-term success.

Here's how to effectively evaluate a crypto project's technology:

- Blockchain Architecture: Understand the fundamental blockchain structure, like what consensus mechanism it uses (e.g., Proof of Work, Proof of Stake).

- Scalability Solutions: Assess how the project addresses scalability issues whether it implements layer-2 solutions, sharding, or other scaling technologies, transaction speed and costs.

- Smart Contract Capabilities: If applicable, examine the smart contract functionality.

- Interoperability: Consider how well the project interacts with other blockchains, like does it support cross-chain transactions or communication, Or Is it part of a larger ecosystem of interconnected blockchains?

- Security Measures: Evaluate the security features and track record.

- Privacy Features: Assess any privacy-enhancing technologies, does the project offer optional or default privacy features?

- Developer Tools and Documentation: Check the resources available for developers.

- Open Source Status: Determine if the project is open source.

While cutting-edge technology can be exciting, it's important to balance innovation with practicality and reliability. A project with solid, well-tested technology often has better long-term prospects than one with flashy but unproven features.

Assess the Competitive Landscape

It's crucial to understand how a project fits into the broader competitive landscape. This analysis helps you gauge the project's potential for success and long-term viability.

Here's how to effectively assess the competitive landscape:

- Identify Direct Competitors: Find projects that are solving similar problems or targeting the same market.

- Analyze Market Share: If possible, determine the project's current market share.

- Unique Selling Proposition (USP): Identify what sets the project apart.

- First Mover Advantage vs. Late Comer Innovation: Consider the project's position in the market timeline.

- Partnerships and Ecosystem: Evaluate the strength of the project's partnerships and ecosystem.

- Future Roadmap: Analyze the project's future plans in the context of the competitive landscape.

A strong competitive position doesn't guarantee success, but it can significantly increase a project's chances of long-term viability. Look for projects that not only compete effectively now but also have a clear strategy for maintaining their edge in the future.

Review Community Engagement and Development Activity

When researching new cryptocurrencies, assessing the level of community engagement and ongoing development activity is crucial.

These factors can provide insights into the project's health, potential for growth,

and long-term sustainability.

Here's how to effectively review community engagement and development activity:

- Community Size and Growth: Look at the number of followers and community members.

- Quality of Discussions: Join community channels and observe the conversations.

- Team Involvement: Assess how actively the core team engages with the community.

- GitHub Activity: Check the project's GitHub repository (if open source).

- Development Updates: Look for regular development updates and progress reports.

- Bug Bounty Programs: Check if the project runs bug bounty programs.

- Hackathons and Developer Events: Check if the project organizes or participates in hackathons.

- Documentation and Resources: Assess the quality and comprehensiveness of developer documentation.

A healthy project typically has an active, engaged community and consistent development activity. However, be wary of artificially inflated community metrics or development activity that doesn't translate to meaningful progress.

The Bottom Line

As we conclude our comprehensive guide on how to research new cryptocurrencies, it's important to remember that thorough analysis is key to making informed investment decisions in the volatile world of digital assets.

Remember, even with thorough research, cryptocurrency investments remain highly speculative. There are no guarantees in this market, and past performance does not indicate future results.

By applying the strategies and considerations outlined in this guide, you'll be better equipped to navigate the complex world of cryptocurrency investments. Always stay curious, remain skeptical, and continue to refine your research skills as you explore new opportunities in this exciting and evolving space.

Written By

S. Vishwa

Vishwa is an experienced SEO Specialist and Blog writer at Botsfolio. Leveraging 7+ years of experience in Digital Marketing and Fintech, he is passionate about crafting high-quality content that informs and engages readers in the finance and marketing sectors.

You Might Also Want To Read

Top Open-Source Crypto Trading Bots - Bots...

Discover the best open-source crypto trading bots for efficient trading strategies. Enhance you...

Jay Sharma

9 minutes

Ichimoku & Fibonacci: Crypto Trading Techn...

Unlock the power of Ichimoku and Fibonacci in crypto trading. Learn advanced technical analysis...

Jay Sharma

10 minutes

Trade vs. HODL - Insights for Maximizing R...

Learn the pros and cons of trading cryptocurrency versus HODLing to make informed investment de...

Jay Sharma

7 minutes

Cryptocurrency Trading Bots: Scam or Legit...

Uncover the truth about crypto trading bots. Are they genuine tools or potential scams? Dive in...

Jay Sharma

9 minutes

Understanding Bitcoin Trading Trends: Gend...

Explore the phenomenon of young men dominating Bitcoin trading and the underlying factors drivi...

Jay Sharma

8 minutes

Wealthsimple for Crypto: Elevate Your Inve...

Experience superior cryptocurrency trading with Wealthsimple. Discover a smarter investing app ...

Jay Sharma

8 minutes

You Might Also Want To Read

Top Open-Source Crypto Trading Bots - Bots...

Discover the best open-source crypto trading bots for efficient trading strategies. Enhance you...

Jay Sharma

10 minutes

Ichimoku & Fibonacci: Crypto Trading Techn...

Unlock the power of Ichimoku and Fibonacci in crypto trading. Learn advanced technical analysis...

Jay Sharma

10 minutes

Trade vs. HODL - Insights for Maximizing R...

Learn the pros and cons of trading cryptocurrency versus HODLing to make informed investment de...

Jay Sharma

10 minutes

Cryptocurrency Trading Bots: Scam or Legit...

Uncover the truth about crypto trading bots. Are they genuine tools or potential scams? Dive in...

Jay Sharma

9 minutes

Understanding Bitcoin Trading Trends: Gend...

Explore the phenomenon of young men dominating Bitcoin trading and the underlying factors drivi...

Jay Sharma

8 minutes

Wealthsimple for Crypto: Elevate Your Inve...

Experience superior cryptocurrency trading with Wealthsimple. Discover a smarter investing app ...

Jay Sharma

11 minutes

The content, portfolios, and insights presented on this platform are provided for informational purposes only and do not constitute financial, investment, or trading advice. Kribx Inc. and its affiliated influencers are not registered investment advisors or broker-dealers. Cryptocurrency trading involves substantial risk and may result in the loss of capital. Users are solely responsible for their trading decisions. Past performance is not indicative of future results.

PRODUCTS

RESOURCES

COMMUNITY GROUPS

© 2026 © Botsfolio